We don’t need to do manual reviews, or use QuickBooks to run 10 different reports – instead we use Keeper.”

- Pam Stocks

- Founder/CEO

Case study highlights

- Keeper’s File Review tools helped On the Books’ team catch hundreds of common bank feed errors, like inconsistent transaction coding and transactions missing payees or classes.

- Keeper centralized their account reconciliation and client communication, improving client relationships and decreasing response times.

- On the Books replaced three different tools with Keeper, giving managers more visibility over the team’s work.

The beginning of On The Books

Pam first cut her teeth in public accounting working in the CAS department at a traditional CPA firm. After identifying the potential to infuse technology and automation into the accounting process, she opened up On The Books, LLC in 2016. Today, Pam leads a team of seven employees who provide bookkeeping, accounting, and consulting services to over 50 clients.

“We’ve become very niched in terms of the clients that we work with and where they are in their business journey,” Pam explains. Her ideal clients are early-stage, venture-backed technology and life sciences startups.

Over the last two years, On The Books has experienced impressive 70% year-over-year growth. As a tech-oriented business owner working with like minded clients, Pam was eager to turn her attention toward finding a tool that would simplify the systems within her practice.

“We grew 70% year-over-year and needed a tool to bring order to the chaos”

The search for a single, reliable bookkeeping platform

After testing a handful of systems from Asana, to ClickUp, to Dext, Pam admitted that she found specific elements she liked within each system, but ultimately found that they were too disconnected and lacked consistency. She needed the perfect solution that could increase transparency, track action items, and streamline the bookkeeping work for her team. “I wanted insights into who was working on which tasks, and when those tasks were due,” she noted.

When Pam decided to try Keeper, she was delighted with what she discovered. Keeper’s native close templates and task management tools helped the team meet deadlines in half the time and increased overall organization and efficiency across the team. “I’ve been able to consolidate and ditch other tools that were not integrated,” said Pam.

Spell check for bookkeepers

Keeper swiftly became the central hub for all of On the Books’ work, because it empowered the bookkeeping staff to tackle the month-end close in a collaborative and error-free way. Keeper’s Close Page is broken up into different sections; with each section consisting of dozens of file review tools to improve the quality of the close itself. These tools allow Pam to delegate a large portion of the review work to her bookkeepers, and solves the task-list issue she previously faced. “I can track what each employee is working on and how far they are in the process of closing clients’ accounts at a quick glance.”

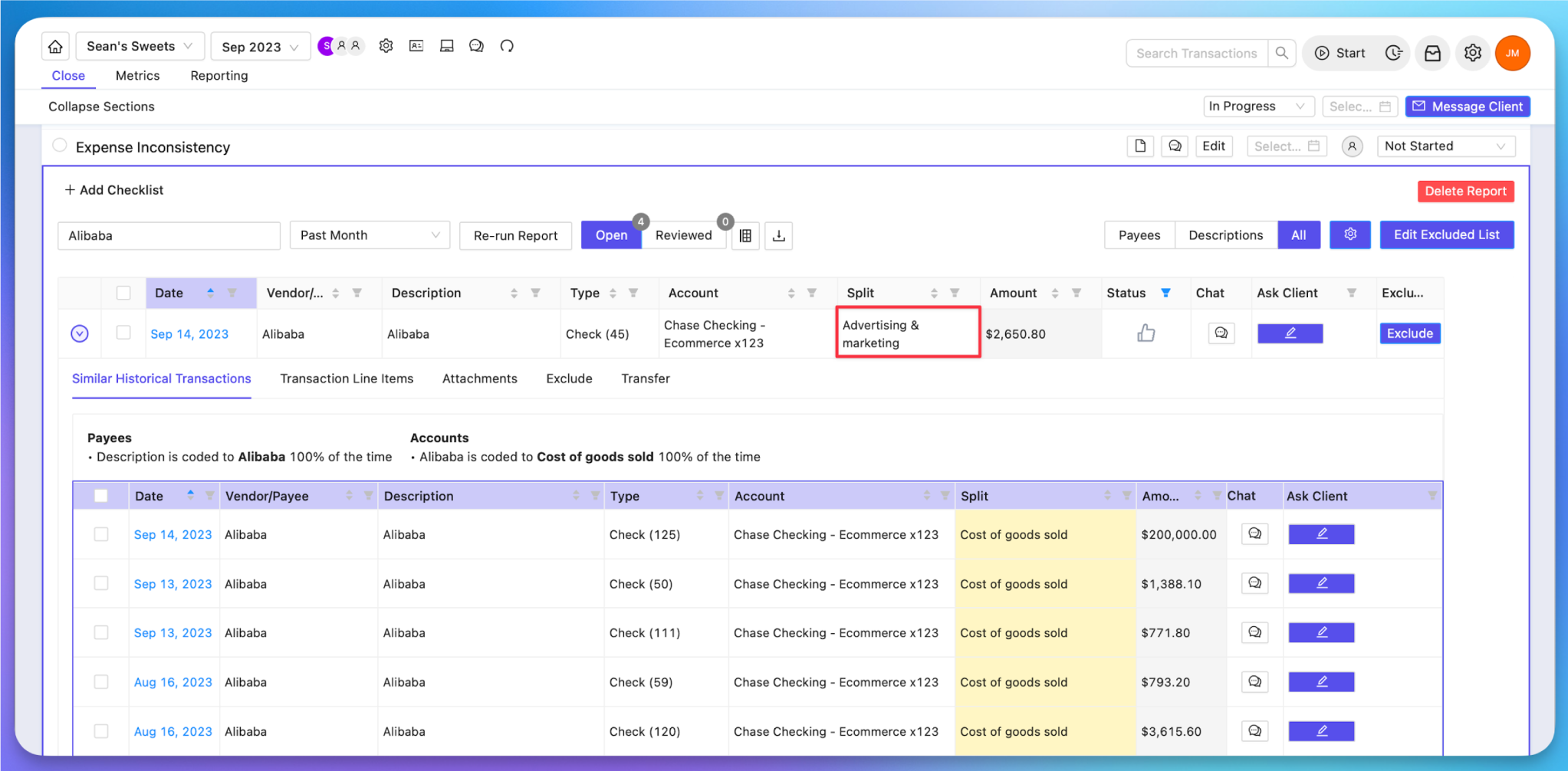

A key feature relied on by the On the Books team is known as the Expense Inconsistency Report. It highlights expense transactions in the current closing period that might be miscoded. The report analyzes each expense in the current period, cross-references those against transactions in the past year, and flags potential anomalies. Because of its integration with QBO/Xero files, Keeper can detect these common bank feed errors and flag transactions without payees, uncategorized transactions, and even those which have not been assigned to a class or location.

“It’s like spell check for bookkeepers,” said Pam. “Task management is one thing, but the major draw was that Keeper ensures my team is always doing things correctly.”

At the current stage of On the Books’ experience with the tool, Pam’s bookkeepers push her to add each and every client to Keeper – because it provides a newfound level of confidence in the accuracy of their work product.

“Our customers’ financial reports are more accurate than ever before. Keeper helps catch the little things that the customer may not care about or notice.”

“Keeper’s Expense Inconsistency Report makes it easy for my team to drill down to the vendor and account level and see things that we were not able to originally identify using QuickBooks on its own,” said Pam. When asked how Keeper helps from a supervisor’s perspective, Pam replied, “Without a doubt, Keeper saves us time from a review standpoint. Mistakes are diminishing and we can review and prepare for client meetings rather than spending time redoing the work.”

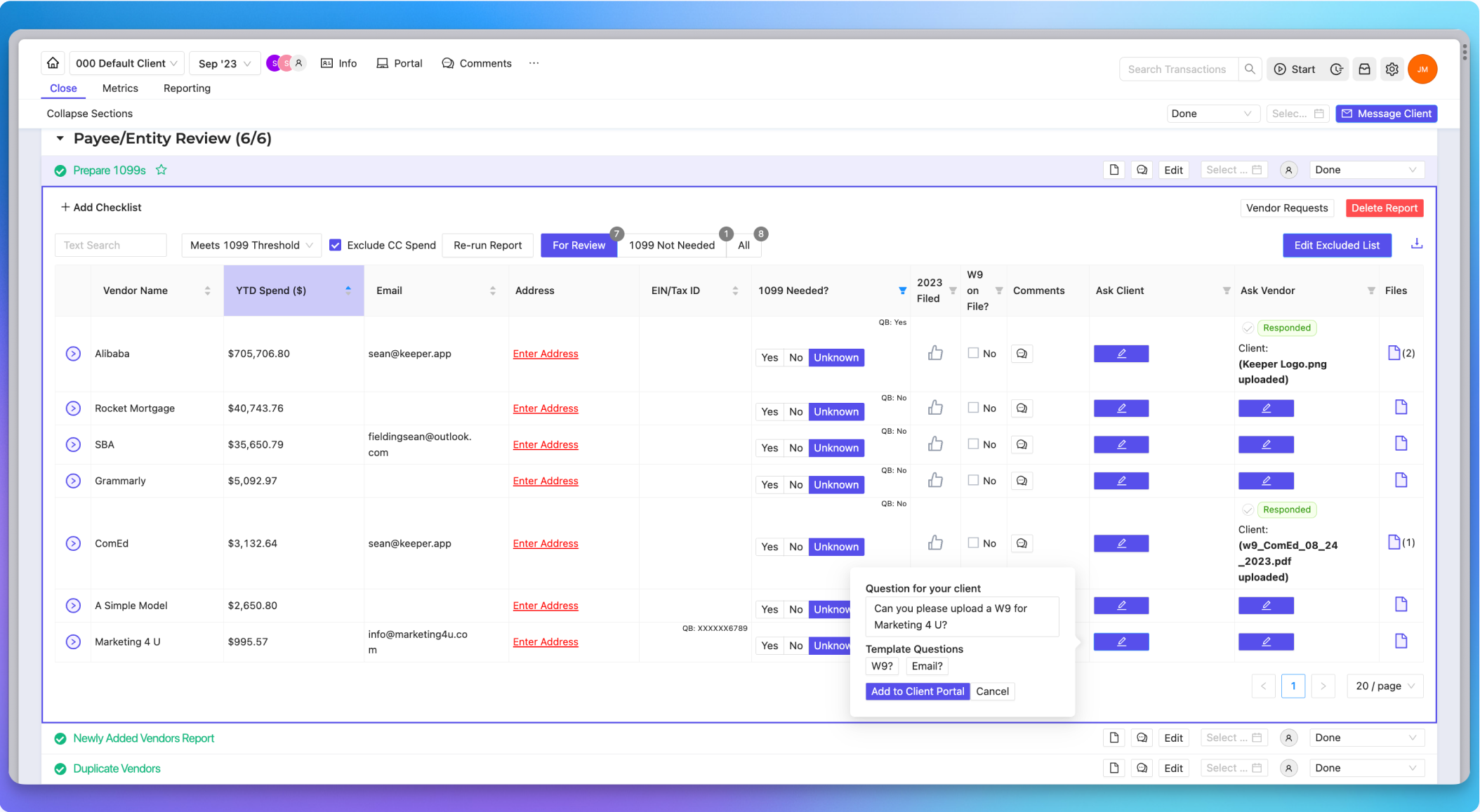

Another top feature used by the team is Keeper’s Prepare 1099s Report. “It’s so easy to let a client know we need a 1099 and when it comes directly from the vendor, it’s so smooth! Keeper’s Prepare 1099s and New Vendor Report helps us catch any missing 1099s immediately. We expect these tools to cut down the amount of time we spend chasing W9s at the end of the year by two-thirds or more.”

Better communication = stronger client relationships

Pam’s team immediately saw the value in Keeper’s integrated platform which centralized account reconciliation with client communication.

“The Expense Inconsistency Report makes it easy for my team to drill down to the vendor and account level and see things that we were not able to originally identify using QuickBooks on its own,” said Pam. “Keeper has become our secure place to store documents and review and answer client questions at the transaction level, instead of having to type everything out in an email or spreadsheet for our clients to review. All the necessary details are visible in one place.”

Before Keeper, the clients that Pam onboarded would forward documents in an email, leading to multiple threads and chaos for the team. Pam was pleasantly surprised at her clients’ willingness to shift from sending emails to using the Keeper Client Portal, and credited the accessibility to Keeper’s magic links. “It allows our clients to login to the portal without having to keep and manage a password. They click a link and go directly to the portal, where they upload documents, answer our questions, and even ask their own if necessary.”

“We no longer have to type everything out in a spreadsheet or email and pray for the client to respond”

Pam’s advice to firms considering practice management software

Of course, not everyone is actively looking to introduce new technology into their practice or rebuild their systems via new software. But Pam sees technology and automation as powerful drivers of productivity, and encourages accounting professionals to remain open-minded about shifting away from antiquated practices. “Keeper has become our safety net. We no longer have to do our reviews manually, or use QuickBooks to run 10 different reports – we can just use Keeper.”

Pam’s team has continued to expand, and she recently hired an Accounting Manager/Supervisor. After joining On The Books and exploring Keeper for the first time, the new teammate said, “I came from a much larger firm, and Keeper would have been so helpful to have there. I do not know why every firm is not using this tool.” Pam sees it the same way, still impressed at the time savings accrued from a supervisor standpoint. “Keeper can easily save you an hour of your time per day, and for $10 a client, it is well worth the investment.”

“I don’t know why every firm in the world is not using Keeper.”

If your firm is ready to scale but is held back by manual bookkeeping tasks, schedule a demo call and start strategizing for success with Keeper.